This page is now archived and will not be updated.

These FAQs can also be downloaded in printable PDF format here: New Lenox Public Library Referendum FAQs (PDF)

- Be open Sundays and extend weekday hours to meet the needs of working families and students.

- Sustained Materials Funding and Expanded Services: This will enable the Library to continue to provide new and up-to-date books, movies, music, while decreasing wait times for downloadable content. More resources will be available to focus on early literacy skills and making the library accessible to everyone, including those who are homebound.

- Long-Term Fiscal Sustainability: It will allow the Library to plan for capital maintenance for our 20-year-old building including HVAC repairs, carpet replacement, more private and collaborative study/workspaces, energy efficient components, parking lot maintenance, wall repairs and painting, window and door replacements, furniture updates, to name a few.

- More Partnership Opportunities: The library can create and maintain connections with area schools to provide every student with complete and easy access to the public library’s resources. In addition, more connections with businesses and senior care facilities can be established.

- Reduced Hours: Due to needed capital maintenance to keep the building operating, hours may need to be reduced in the future.

- Significant Service Decrease and Limited Materials: There will be a noticeable decrease in in-house and external classes and programs: outreach, homebound delivery, and off-site storytimes to local organizations and schools will be affected and possibly discontinued. Selection of materials will be limited and there will be longer wait time for new books, movies, music, computers, and downloadable content.

- Minimized Maintenance: Basic repairs will only be completed. $5.4 million over the next 10 years is needed for capital improvements, such as repairing elevators, commercial heating and air conditioning system, worn carpeting, chipping paint, and replacing lighting.

- Less Technology: Technology access and services will be reduced therefore limiting resources available to patrons, such as public computers, free technology classes and limited funds to purchase updated equipment.

Per the 2010 census, there are 36, 847 residents of the New Lenox Public Library District. In 2017, the New Lenox Public Library District worked closely with the Will County GIS Department to obtain an updated and accurate updated resident count, which was 40,733. In just 7 years, the district’s population grew over 10%. View the New Lenox Public Library District Map (PDF).

No. The New Lenox Public Library District is an entirely separate taxing body from the Village.

The New Lenox Public Library District is governed by Board of seven Library Trustees who are elected by district residents. Each Trustee serves for six years and the Board is responsible for setting Library Policy and hiring the Library Director.

Although the Library works together with the Village to assist with year round events, the Village provides no funding to the Library. The graph below details the percentage of an average tax bill that goes to library funds.

| Property Tax | Percentage |

|---|---|

| School District 122 | 45.8% |

| High School District 210 | 24.0% |

| Will County | 6.7% |

| New Lenox Fire District | 6.5% |

| Village of New Lenox | 4.6% |

| Joliet Community College District 525 | 3.3% |

| New Lenox Community Park District | 2.7% |

| New Lenox Public Library District | 2.5% |

| New Lenox Township | 2.2% |

| Forest Preserve | 1.7% |

Yes, the voters approved bonds to pay for the construction of the current library building in 1999. These bonds are very similar to how a home mortgage works. These bonds, or the library's mortgage, are paid for by levying for a construction bond tax rate. The bonds, or library mortgage, will be paid off in full as of December 2019, so the library will no longer be collecting for the construction bond tax.

Despite the construction bonds being approved by voters, an increased operating tax rate to run a larger building was never passed. Therefore the operating tax rate is intended for size of the previous building, which is 19% of the size of our current library. The library has not had a voter approved operational tax increase since 1946.

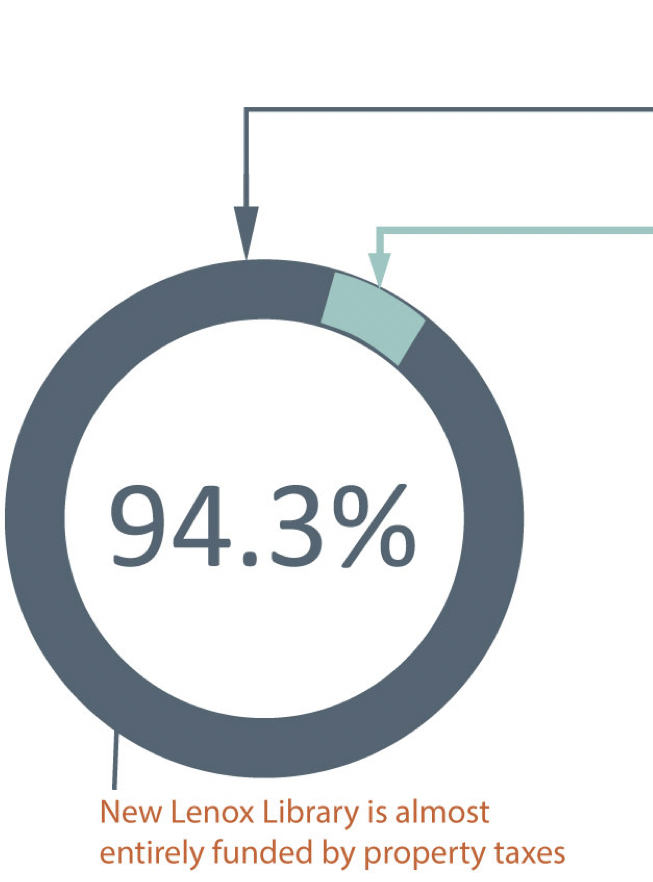

94.3% of library funds come from property taxes. The remaining 5.7% is received from impact fees, overdue fines, donations and grants (see illustration and table below).

| Type of Income (Fiscal Year Estimated Income 2019–2020) | Percentage |

|---|---|

| Property Tax (Operating Levy) | 62.05% |

| Property Tax (Bond Levy) | 32.25% |

| Fines and Fees | 0.83% |

| State Grants | 1.47% |

| Donations | 0.68% |

| Replacement Tax | 0.48% |

| Café Rent | 0.10% |

| Developer Fees | 1.07% |

| Miscellaneous | 1.07% |

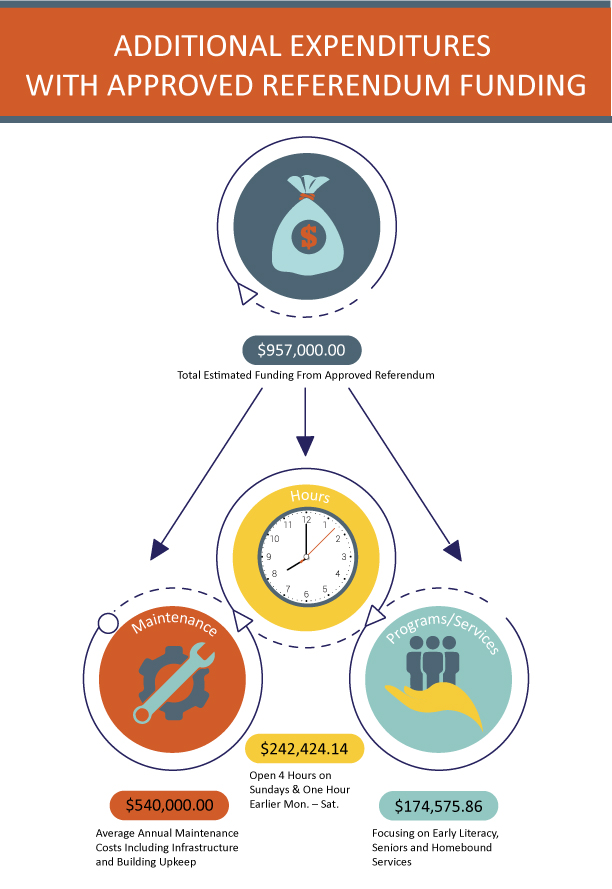

In order to be open Sundays for four hours and earlier Monday through Friday, it would cost $242,424.12 in building and staffing costs. On average, $540,000.00 will go to building maintenance, and $174,575.86 will be allocated to programs and services that focus on early literacy, homebound services and seniors. There will be years that the library spends less or more on maintenance items depending on what infrastructure or upkeep is required for that fiscal year. As a result, that difference in maintenance funding will be directed to or from programs and services.

The construction bonds that were approved by voters in 1999 will be paid off in December 2019. As a result, the library will no longer be collecting taxes for this fund. In order to be fiscally responsible, the Board of Trustees has decided to ask the community to vote upon additional funds (equal to the tax rate of the expiring construction bond levy) for the operating tax. The operating tax allows us to purchase materials, keep the building running, offer programs and events, pay staff, and attend to maintenance items. Since the requested increase for the operating tax rate equals the decrease in construction bond tax rate, this will be a zero tax rate increase.

After a professional facility assessment was completed by a third party, it was found that the library will require $5.4 million over the next 10 years to attend to building maintenance needs.

| Zero Tax Rate Change | 2018 Tax Rate | Proposed Zero Tax Rate Change |

|---|---|---|

| Tax Rate for Operation | 0.1518 | 0.2239 |

| Tax Rate for Construction Bonds | 0.0721 | +0 (Zero) |

| Total | 0.2239 | 0.2239 |

“Shall the limiting rate under the Property Tax Extension Limitation Law for the New Lenox Public Library District, Will County, Illinois, be increased by an additional amount equal to 0.0721% above the limiting rate for the purpose of general library purposes for levy year 2018 and be equal to 0.2239% of the equalized assessed value of the taxable property therein for levy year 2020?”

(1) The approximate amount of taxes extendable at the most recently extended limiting rate is $2,019,032, and the approximate amount of taxes extendable if the proposition is approved is $2,978,006.

(2) For the 2020 levy year the approximate amount of the additional tax extendable against property containing a single family residence and having a fair market value at the time of the referendum of $100,000.00 is estimated to be $24.03.

(3) If the proposition is approved, the aggregate extension for levy year 2020 will be determined by the limiting rate set forth in the proposition, rather than the otherwise applicable limiting rate calculated under the provisions of the Property Tax Extension Limitation Law (commonly known as the Property Tax Cap Law).

For every $100,000 of home value, the amount will be $24.03 per year. Again, the taxpayer is already paying this tax rate in the form of building construction bonds. The library is simply requesting that this portion of the tax rate that is expiring be moved to the operating tax rate. If the referendum did not pass, the taxes paid would decrease by $24.03 per $100,000 of home value.

The library is very grateful for the many volunteers that assist us! That being said, all library staff members are paid for their work.

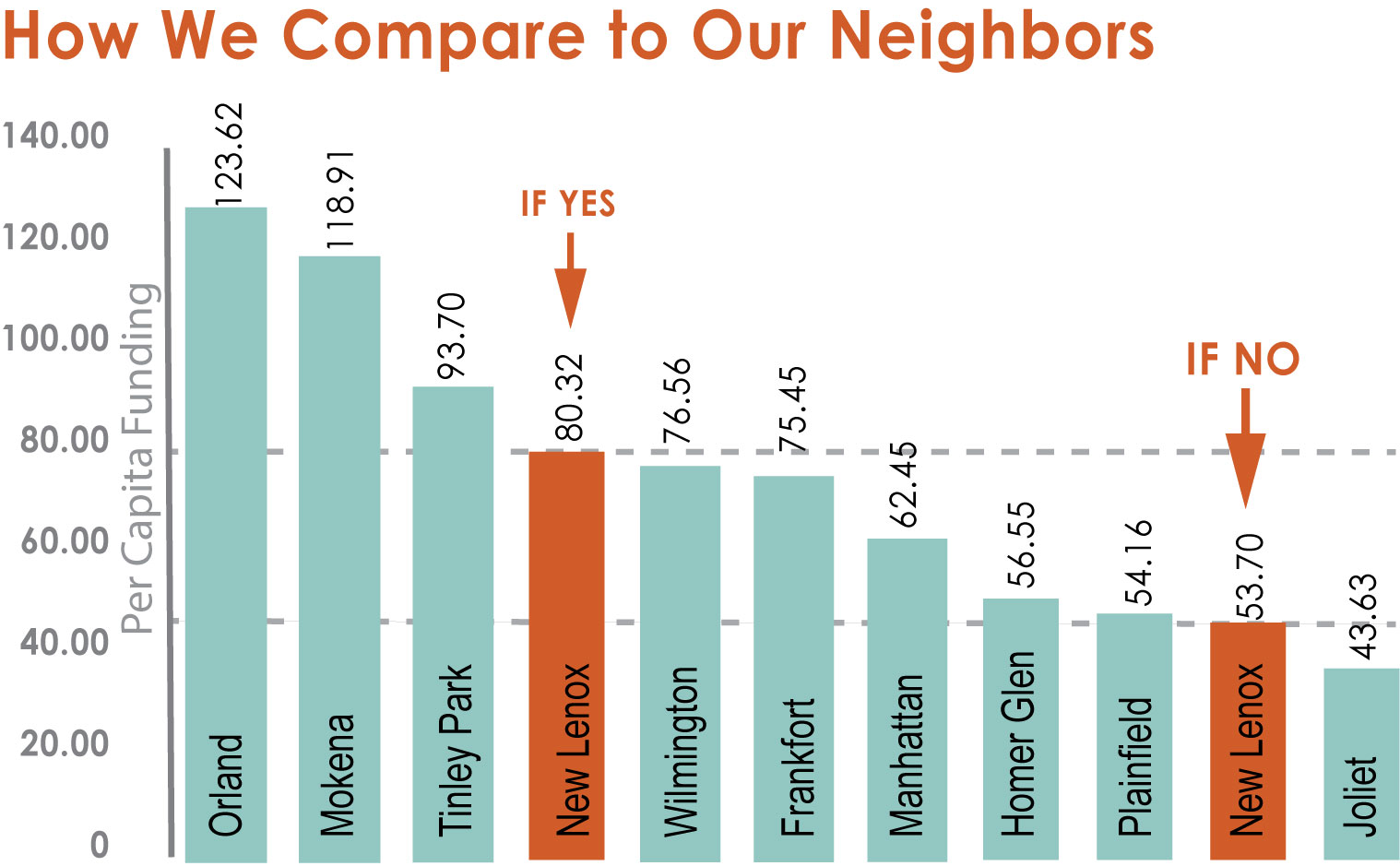

Sourcing information from the Illinois Public Library Annual Report from the Illinois State Library, you can see how we compare to our neighboring libraries:

For easier reading and more detailed text for screen readers, here is the information repeated in the table below:

| Library | Per Capita Funding |

|---|---|

| Orland | 123.62 |

| Mokena | 118.91 |

| Tinley Park | 93.70 |

| New Lenox (If Yes) | 80.32 |

| Wilmington | 76.56 |

| Frankfort | 75.45 |

| Manhattan | 62.45 |

| Homer Glen | 56.55 |

| Plainfield | 54.16 |

| New Lenox (If No) | 53.70 |

| Joliet | 43.63 |

The $100,000 fair market value is taken directly out of the referendum questions on the ballot. The District has no choice in how the questions is worded as the wording comes from the County Clerk and is regulated by Illinois State Statute.

An operating tax increase is a set rate change, whereas bonds require taxpayers to pay interest during time of repayment, similar to a home mortgage. Facility assessments and planning studies conducted by professional third-party companies have demonstrated a need for long-term sustainable funding. By ensuring building maintenance issues are attended to, the library will be able to maintain materials and program budgeting levels. By avoiding bonds, the library will also save taxpayers money since no interest will be involved from borrowing monies.

Please call Library Director Michelle Krooswyk at 815-485-2605 ext. 101.